Epf balance check online uan

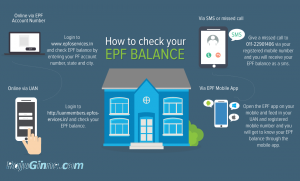

You can check pf balance at employee provident fund portal India website (epfIndia.com).

For this, you have to enter PF number and mobile number.

After entering the details you can of balance details to the registered mobile number.

Step by step process to check Epf balance

- Visit epf portal,

- Click on check Epf balance option under services.

- Select the state after that select the epfo office location.

- Enter establishment code if you don’t have then leave it as it is,

- Finally, enter your provident fund number.

- Last but not least enter your mobile number. click to get epf balance details.

Click on get balance details. You will epf amount status on your mobile by SMS.

Pf balance by SMS:

You can Pf balance by sending a small from registered mobile number.

EPFOHO UAN <ENG> to 773 8299 899

But your epfo number must be UAN activated. You can check status from uanmembers.epfoservices.in

With this portal, you can request new UAN number and activate later. Also, track the UAN status online.

Pf balance by missed call

Give a missed call to below number from UAN activated phone number.

01122901406

You can dial this number to get Pf balance details.

Pf statement for checking epf balance: pf statement can be available from epfo member portal at http://members.epfoservices.in.

register at epfo member portal not did early, log in with pf details and download the pf statement and check balance details.

UAN passbook download on uan portal

Now all the employees prefer uan portal to download uan passbook to check epf balance details. why we need to worry about epf balance details. we could get Pf balance By SMS on every transaction generally every month. Becuase only once a month pf amount will increase by the contribution of employer and accumulated interest by epfo.

How to check Pf claim status on epfo?

Epfo claim status checking process as same as EPF balance status.

- Visit epfIndia.com, click on Pf claim status that will redirect you to epfo claim status page. There you can do the following things. Select the state, city of your epfo office example Delhi, Kolkata, Bangalore, Ahmadabad, Pune, Mumbai, Lucknow, Hyderabad and other etc.

- Enter epf number details and finally Pf number.

- The last thing is to enter your epfo registered mobile number.

- Click on get Pf claim status online.

But you can get the details of the mobile number by SMS.

or

- Please click on the following link to find the status of your claim submitted in any of the EPFO Office.

- Select the EPFO office where your account is maintained and furnish your PF Account number.

- Leave the extension field blank, in case your account does not have one.

Epf login /registration online payment

employees can register at epfo services portal members.epfoservices.in.

For registration, employees can enter the details like Pf account number and identity proof number (Voter ID, passport, driving license number), pan card number and other etc. you can still register at epfo login portal.

EPFO UAN status

Let’s get the part of UAN status. UAN stands for universal account number at the epfo case it’s allotted to every Pf account holder by epfo.

The main benefit is: withdraw money without employer sign.

You of the account remains the same if switched from one company to another company.

- Getting & activating the UAN number

-

1st part is requesting UAN number from epfo.

- For this, you need uid or Aadhhaar number along with other details.

- 2nd part is activating UAN at uan members.epfoservuces.in

After activation you can check UAN status regular basis may be it get up to 7 days to get activated.

With UAN you can log in with UAN number & password to download Pf statement /passbook.

UAN Activation UAN portal Registration

after you know the uan number by uan status or by the employer. visit the uan portal or on the mobile app, Enter your uan number fill the further details of the epfo member. set password for uan login. then login ASAP for downloading uan member card and passbook for pf balance details.

Epf payment online net banking SBI:

You can pay Pf payment monthly with sbi Internet banking. and other banks too. With the integration of bill desk services, you can pay by credit card debit card and all the possibility ways in online.For offline payment, you have to visit the bank. Visit Epfindia.com or original source at pf balance.

UAN Member portal services

for availing uan services members have to registered uan portal with uan number. but we have already registered with the epfo portal with pf number and checking epf balance fine, then why is uan portal?

UAn portal aimed to reduce third party interaction and focusing on transparency to avoid misuse of epf funds.

what are the uan portal benefits?

the perfect example is pf withdraw without any documentation & interaction. with uan portal directly withdrawal epf money to the bank account online. Not only this one.

Change Address & Date of birth Update KYC details including Aadhaar pan bank details etc. But name change if pf account needs to contact employer and pf office.

EPFO Website, not working issues.

uan portal down from 3 months everybody saying. but it can access now, main reason uan members portal and employer uan portal merged with the unified uan portal.

Epf withdrawal eligibility

you can check pf withdrawal eligibility while filling epf withdrawal form online. if you are trying to withdraw epf offline check epf rules.

general epf withdrawal rules are after 2 months of unemployment. minimum 6 months contribution from the employer.full withdrawal is allowed only at the time of retirement or 58 years age.

TDS On epf withdrawal: without PAN card 20%, with pan 10%, 5 years old pf account no TDS. also no tax on below withdrawal of 50,000.

EPF Contribution by employee & employer

- employees contributes 12% of the basic pay to EPF.

- employer contributes 8.33% towards the employee’s pension scheme 3.67% to the EPF Scheme (12%).

- employers 0.5% contributions to EDLI,

- admin charges 0.65% -> EPF, 0.01% -> EDLI .

Is PF mandatory for all companies?

If a company has over 10 or 20 employees only then they have to register for the Provident Fund.

Is PF mandatory for all Employees?

Yes, If your salary + Allowance below Rs.15,000. Above 15000 its voluntarily.

Is employer contribution to PF is part of CTC?

Yes! CTC mostly includes TA, DA, salary, medical, insurance, PF, bonus, paid leaves etc.

Is employer contribution to PF comes under 80c?

Yes up to 1 lakh under Income tax act section 80C.

Is the employer’s contribution to PF taxable?

Directly No, But when calculating the tax gross salary without deductions calculated under tax and up to 1 lakhs exempted under section 80C (by contributing to PF, life insurance, FD, ELSS equities etc).

Ask a Question:

You must be logged in to post a comment.